Child Tax Credit 2024 Eligibility Requirements Chart – Congressional negotiators announced a roughly $80 billion deal on Tuesday to expand the federal child tax credit that, if it becomes law, would make the program more generous, primarily for low-income . During the COVID pandemic, the child tax credit was expanded with payments made monthly. It’s back to pre-pandemic levels, however, but, if you have children under the age of 17, you could be eligible .

Child Tax Credit 2024 Eligibility Requirements Chart

Source : www.cpapracticeadvisor.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

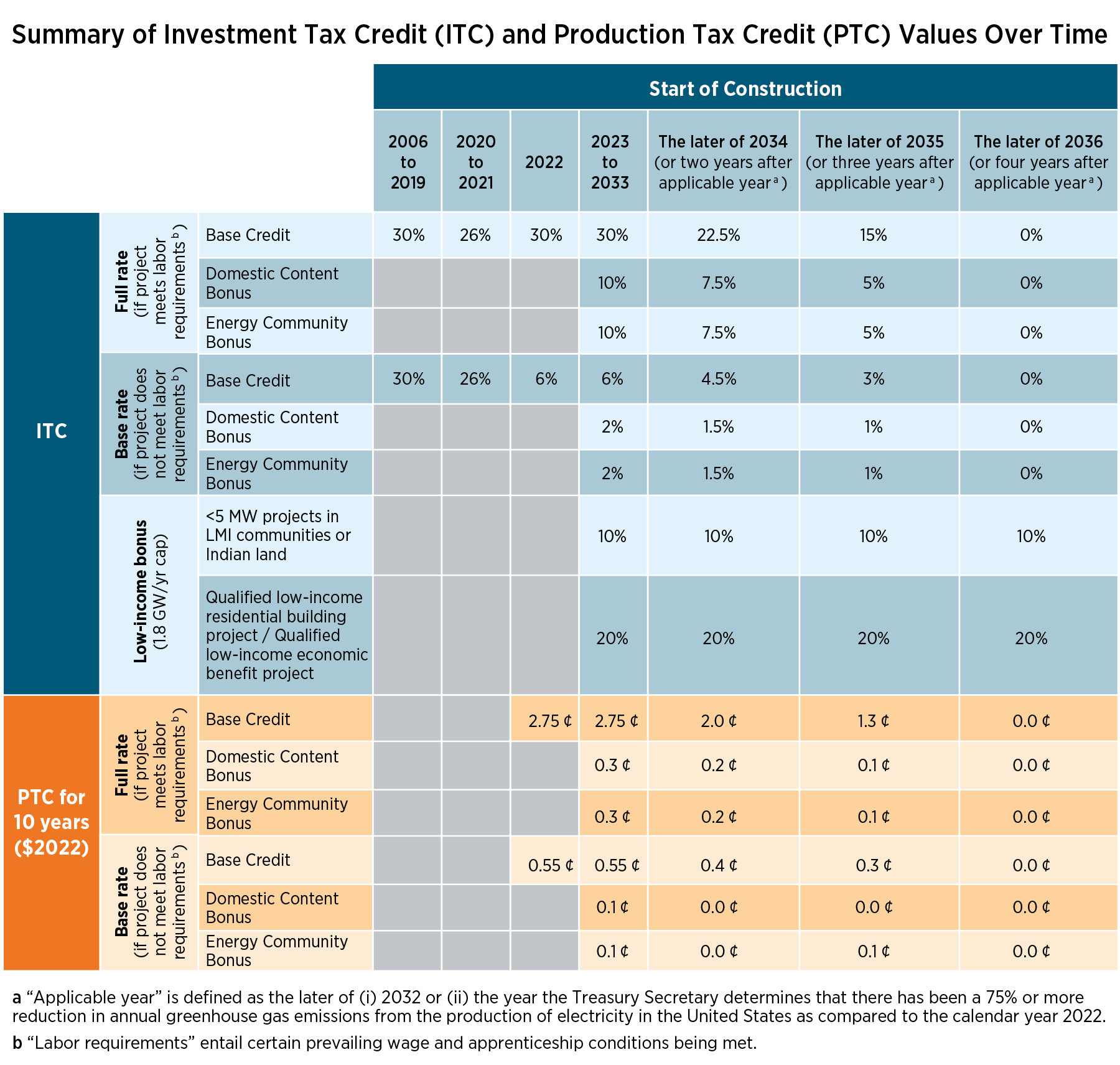

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

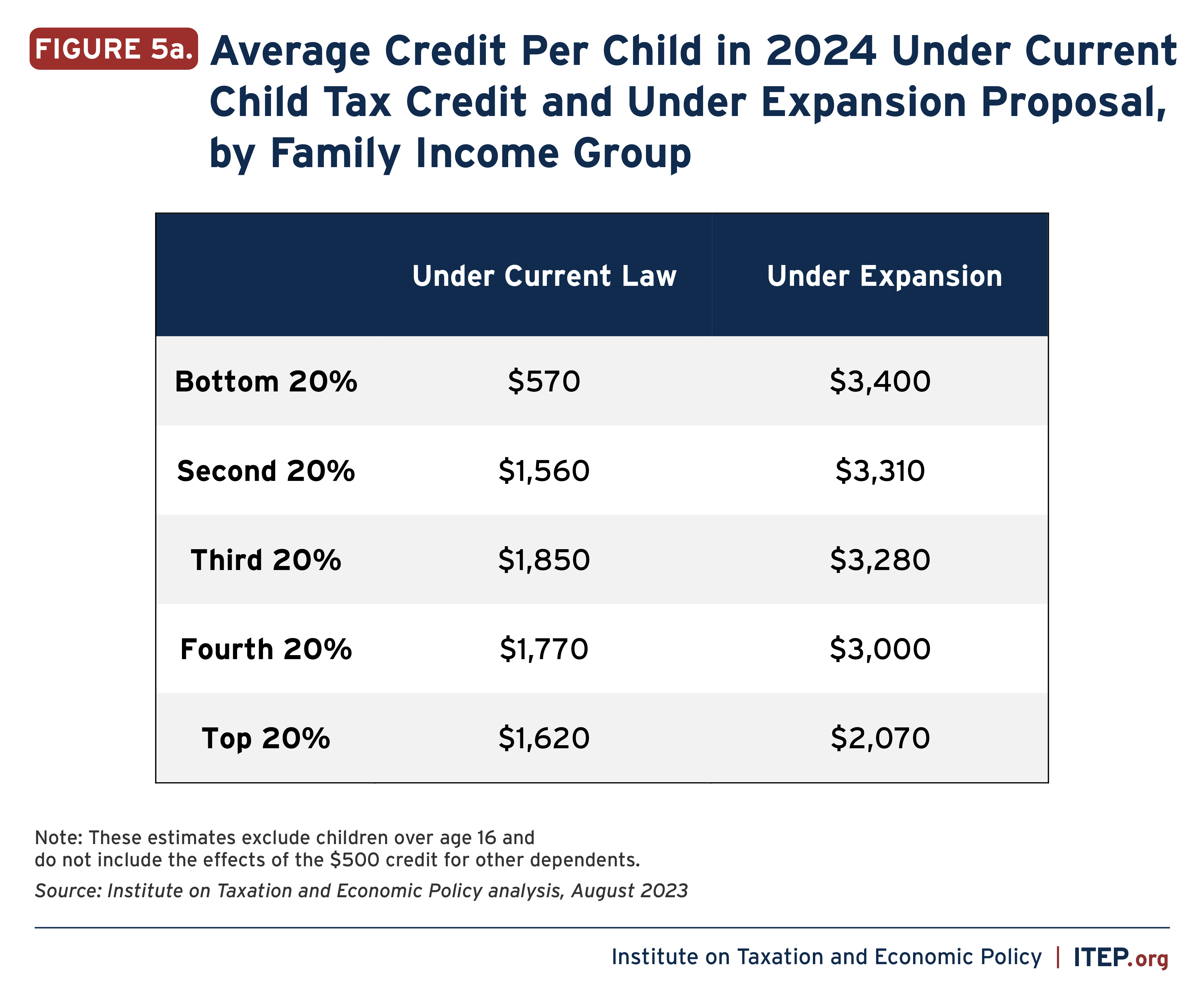

Expanding the Child Tax Credit Would Advance Racial Equity in the

Source : itep.org

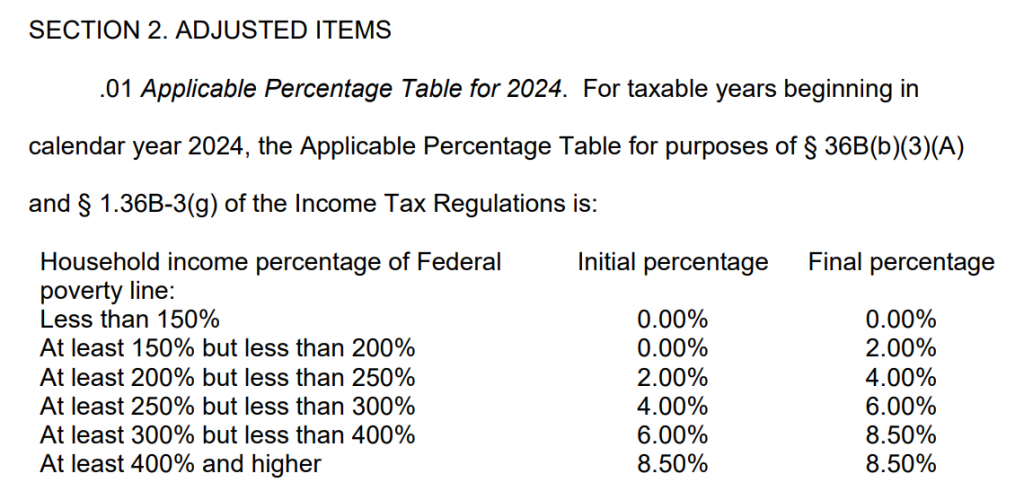

Child Tax Credit 2024 Eligibility Requirements Chart IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA : Under rules established in the Inflation Reduction Act of 2022, the EV tax credit allows eligible taxpayers to claim a maximum credit of $7,500 for new EVs, and up to $4,000, limited to 30% of the . The Inflation Reduction Act made significant changes to the kinds of tax credits people could get for buying electric vehicles in the U.S. Under the law, which President Biden signed in August .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)