Tax Relief Act 2024 Summary Form – it’s necessary to complete Form 656-B. If dealing with the complexities of this 32-page document becomes overwhelming or causes undue stress, hiring a reputable tax relief company may prove . Commissions do not affect our editors’ opinions or evaluations. Tax relief companies say they can work with the IRS and state tax agencies to reduce or eliminate your tax debt. But the Federal .

Tax Relief Act 2024 Summary Form

Source : www.ncsha.org

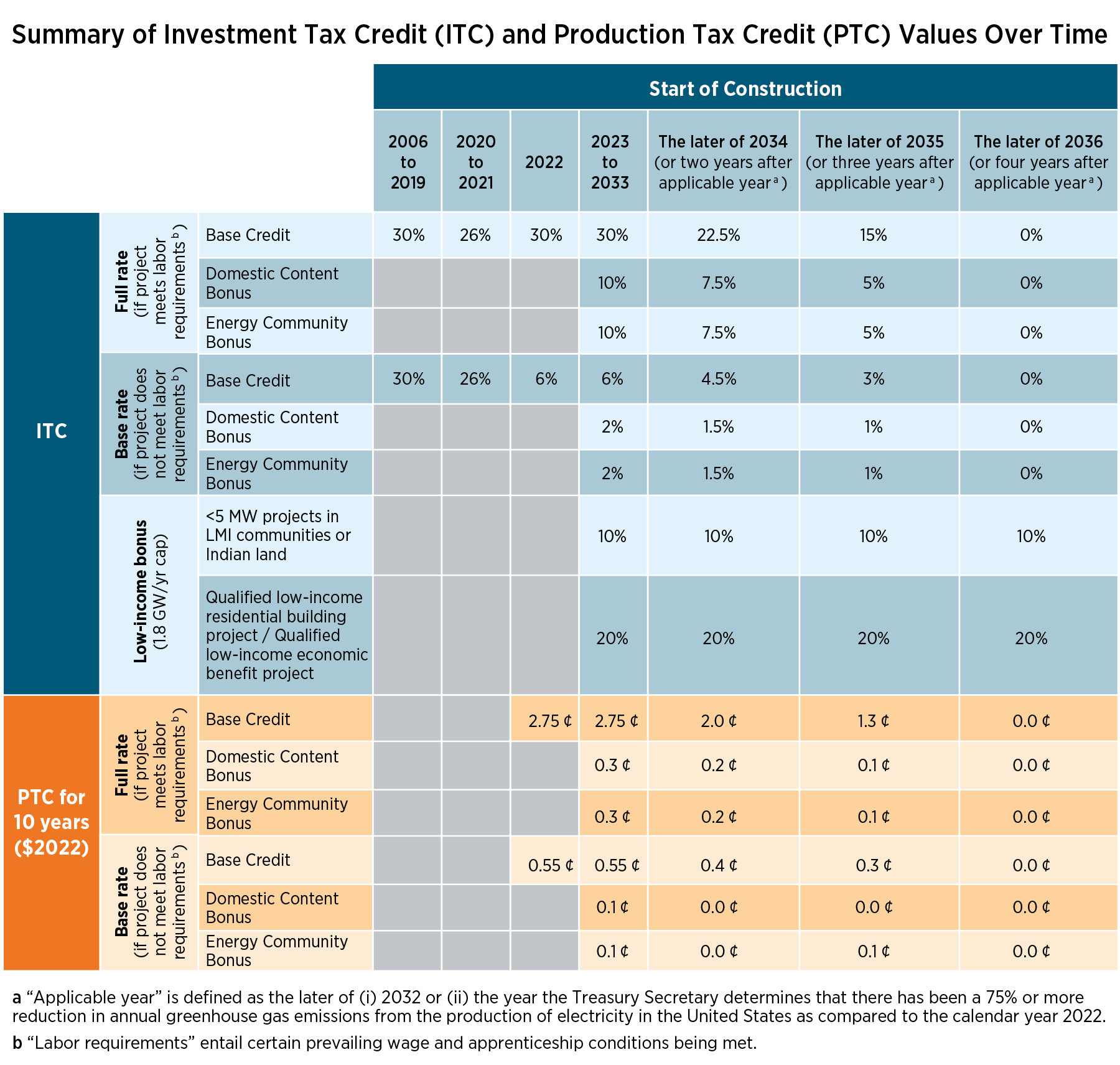

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

The Bluebook: A Summary of Key Tax Topics for 2024 | FORVIS

Source : www.forvis.com

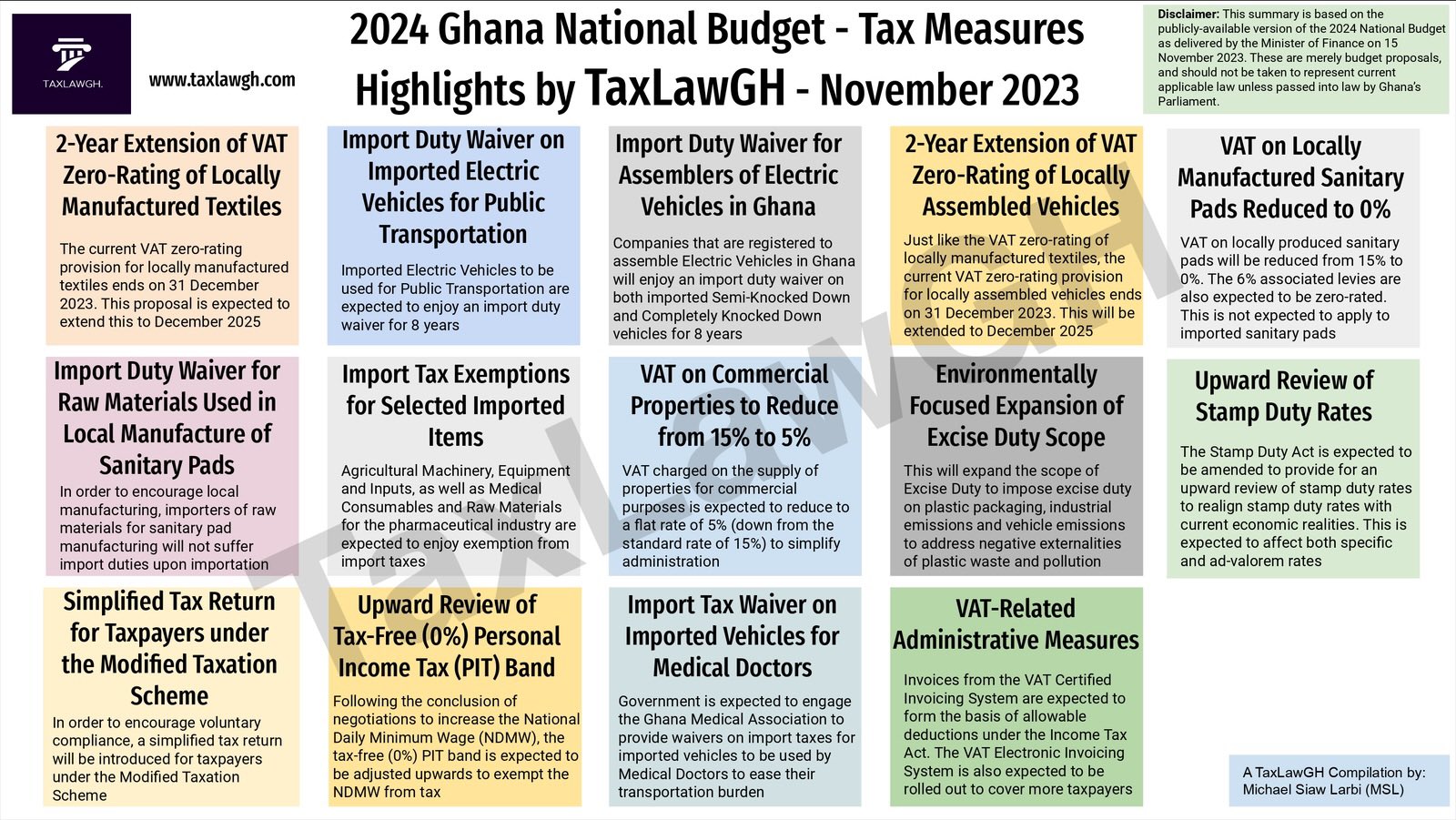

TaxLawGH on X: “In case you missed our 2024 Budget Highlights (on

Source : twitter.com

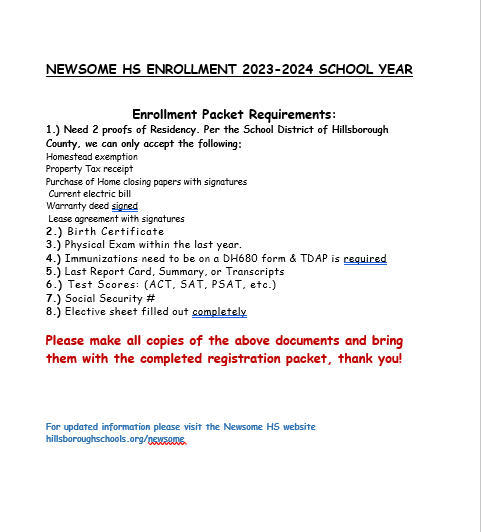

Enrollment Procedures for 23 24

Source : www.hillsboroughschools.org

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Tax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Source : www.schwab.com

Tax Relief Act 2024 Summary Form Legislation & Legislation Proposals Archives — NCSHA: The Income Tax Department has notified ITR forms 1 and 4, which are filed by individuals and entities with annual total income of up to ₹50 lakh, for assessment year (AY) 2024-25. The I-T . Here’s what you need to know about when to file taxes in 2024. Ads by Money. We may be compensated if you click this ad.Ad The right Tax Relief firm need to file a Form 1040 (or Form 1040 .

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)